Is Black Friday back with a new Switch 2?

Black Friday is back. But are we still that into it or is that just leftover lockdown energy? Remember 2020, when Switches disappeared in minutes and we were flexing our Animal Crossing islands (and yes, the fruit absolutely mattered). With a new Switch on the horizon, is Black Friday still the best time to buy, or just a myth we love to repeat? I’m pulling some google trends data to see if 2025 can beat peak lockdown.

Like everyone else, I grabbed my Switch in lockdown and tried to make my island pretty (kinda). Nintendo nailed the moment: tons of free time, everyone craving a distraction. E-commerce exploded because we all had hours to browse and pick up hobbies, perfect for that “best deal of the year” hype.

But in the last five years, buying behaviour has shifted. Black Friday used to be a full-on cultural event: 5 a.m. queues, doorbusters, elbows out in the TV aisle. Now it’s mostly tabs, trackers, and promo codes and week-long “Black Friday” that bleeds into Cyber Monday. We’re savvier, too: price-history charts, browser extensions, and a healthy dose of “is this really a deal?” skepticism.

After years in e-commerce, I know Q4 is pure chaos and Black Friday is the main event we spend all year preparing for. But is it still worth pouring all our energy into, or is the hype fading? Time to stop guessing and test it properly.

So here's what I'm going to do:

I'm going to grab the data for Black Friday and Nintendo Switch searches from google trends, then work out the uplift for each so I can analyse what's really going on.

Quick reminder: pulling Google data is a patience test. Endless waits, too much coffee, and a silent cry. It does throw a TooManyRequestsError so often and no, a 60-second sleep won’t magically fix it. Sometimes you just try again tomorrow.

As we’ve said before, Google Trends is normalised, which makes comparisons messy. The good news: Leigh built a basket method that fixes the normalisation and stitching headaches. It still takes ages, but it works. If you want the full why-and-how, check Leigh’s step-by-step breakdown in our earlier videos.Scale’s sorted, now we just need to pin the exact Black Friday date.

Black Friday isn’t a fixed date, it’s the Friday after the fourth Thursday in November. I could look up each year manually, but I’m a data scientist (read: lazy-efficient), so I’ll just map the dates with a function for the last five years.

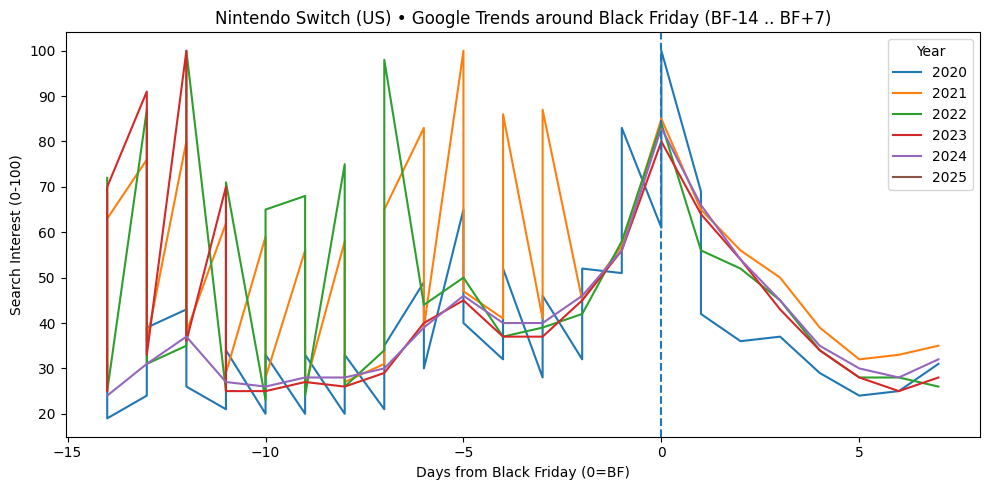

To measure the uplift properly, I’m setting baselines from the pre-periods (28 days before and 7 days before Black Friday) and then taking a 3-day Black Friday window to calculate search uplift. With those KPIs in place, the picture’s clear: 2020 shows a massive spike, and Black Friday definitely juiced Nintendo Switch demand.

We ran the KPIs on unscaled Google Trends first on purpose. Why? To show the pain. Unscaled looks fine inside one year, but the second you compare US 2020 vs US 2025 (or countries), the numbers stop meaning the same thing.

So we clean it, stitch it, and scale it properly. Same KPIs, but now the story holds up across years and markets. Result: fewer squiggles, clearer answers. Bottom line: unscaled proves why scaling matters. A scaled, tidy dataset makes the analysis actually useful. Flatter peak, fatter week and now we can measure it fairly.

a graph to show google trends around Black Friday

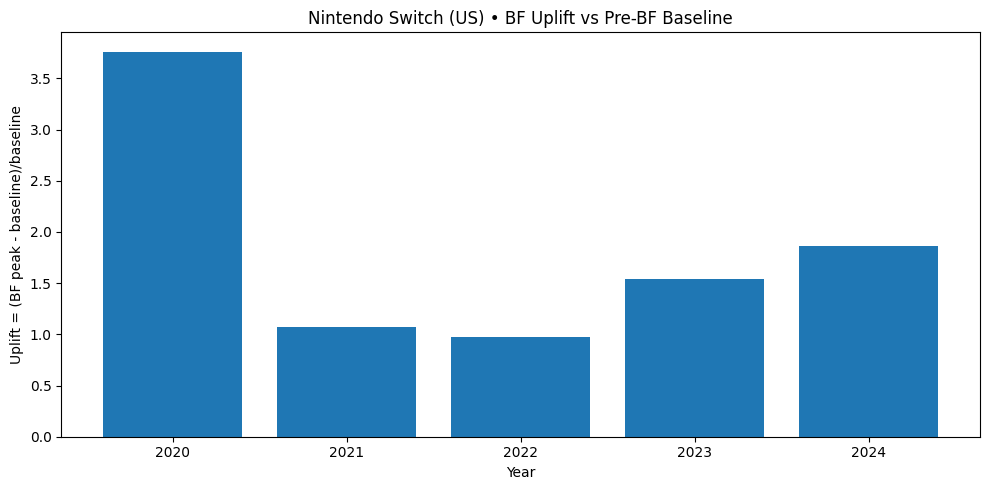

Peak Uplift Trends: Measuring the Post-Lockdown Recovery

With that in place, look at this chart of Black Friday uplift vs the pre-BF baseline in the US. 2020 is the wild outlier about 3.8× baseline thanks to lockdown and scarcity. 2021–2022 dropped hard (roughly 1.0 -- 1.1×), probably affected by the fact that everyone bought a switch last year. 2023 rebounds to around 1.55×, and 2024 steps up again to roughly 1.85×. The headline: 2020’s single-day surge hasn’t returned, but since 2022 the Black Friday effect has been rebuilding. And remember, this is peak uplift; the fuller story comes from the 10-day AUC, where a flatter peak can still mean a bigger overall season.

a graph to show Black Friday uplift and pre Black Friday baseline

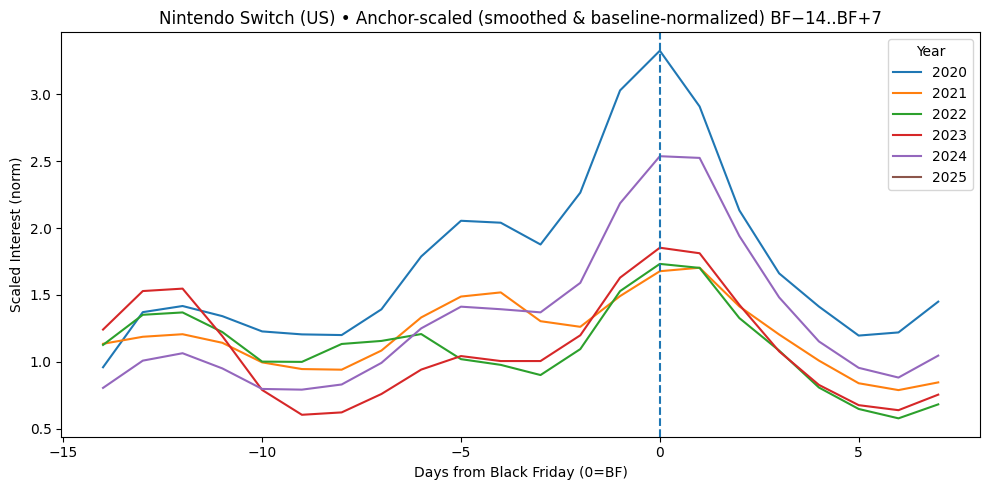

In the scaled view, we can clearly see the differences and identify the true peaks. 2020: classic lockdown surge steep ramp, huge day-0 peak (~3×+ baseline), then a quick cool-down. It’s all spiked, little runway.

2024: modern pattern flatter peak, fatter week. The line sits elevated before and after BF, so the 10-day area is strong even without a towering peak.

a graph to show the interest of the Nintendo Switch and days from Black Friday

From Messy Time Series to Meaningful Insights

But that's not all we can do, we can squeeze more intel out of this data by using feature engineering = turning the messy time series into clear, comparable signals. On the scaled, normalised Switch series, we slice three windows—run-up (BF−28→−1), core week (BF±3), and season (BF−14→+7)—then build simple features that answer specific questions:

Run-up: the 28 days before Black Friday. Used to measure baseline and momentum heading into the event.

Core week: Black Friday itself plus 3 days either side (a 7-day band). Captures the main spike from early deals through the weekend.

Season: two weeks before to one week after. Gives broader context and includes the Cyber Monday tail.

bf_peak_norm: how high did Black Friday actually spike? (true, apples-to-apples peak)

auc7_norm: how big was the whole week? (flatter peak, fatter week still scores)

pre14_slope: were searches accelerating into BF? (momentum in the run-up)

rise_last7: how much did the last week push? (BF−7 vs BF−1 lift)

We only keep years with solid coverage in the pre-period and BF windows; anything too sparse gets dropped. That leaves a clean, per-year table that separates spike power (peak), season size, and build-up momentum (pre-BF slope and last-7-day rise). With the series scaled and normalised, those features are apples-to-apples, so we’re not arguing with raw Trends scales.

From there, two simple models answer two simple questions. Logistic Regression asks, “How likely is 2025 to match 2020’s spike?” We turn the target into a yes/no (peak ≥ 2020), fit a linear boundary, and get an interpretable probability you can actually say on camera. Linear Regression asks, “What peak size should we expect in 2025?” Same inputs, but now we predict the magnitude; it’s fast, transparent, and the coefficients tell you how much each factor lifts the peak. We then compare that predicted peak to 2020.

Why keep it this simple? With only a handful of years, fancy models overfit and hide the story. These two give clear coefficients, honest uncertainty, and map perfectly to our KPIs: classify whether 2025 reaches 2020, and estimate how big the 2025 peak will be. Clean features → scaled comparisons → straight answers.

Quick read on the model results, then we’ll land the plane:

Logistic (hit 2020-level spike = yes/no):

Coeffs say AUC7 is the boss (0.814), rise_last7 helps (0.105), and pre14_slope barely moves the needle (0.011). The big negative intercept (-12.778) means you need a sustained, high AUC week to cross the 2020 bar—one noisy day won’t do it.Linear (how big the 2025 peak will be):

All three matter, but differently: AUC7 lifts the peak (0.166), rise_last7 adds a clear bump (0.244), and pre14_slope matters more here than in the classifier (1.329), meaning steady pre-BF momentum fattens the peak even if it doesn’t decide the yes/no.

Translation: if 2025 wants to rival 2020, it’s not about a single doorbuster, it’s about owning the week (AUC) and finishing strong in the last 7 days. Momentum helps shape the peak, but the area wins the game.

That’s the story: we started unscaled to show the pain, scaled and stitched to compare fairly, engineered features to separate spike power / season size / build-up, and used two simple models for two straight answers.

My call: 2025 can’t out-spike 2020 on one day, but with bundles and a solid last-week push, it can win the 10-day season. Flatter peak, fatter week, and now we can measure it.

Come on the journey with us and keep being Evil